ENVISIONCARE INSURANCE GROUP

The Medicare “Donut Hole”

Medicare Part D was originally designed to cover the majority of a beneficiary’s prescription drug costs. Of course, each individual’s need for medication varies, so some people end up with prescription drug costs that exceed the limits of their Part D plan.

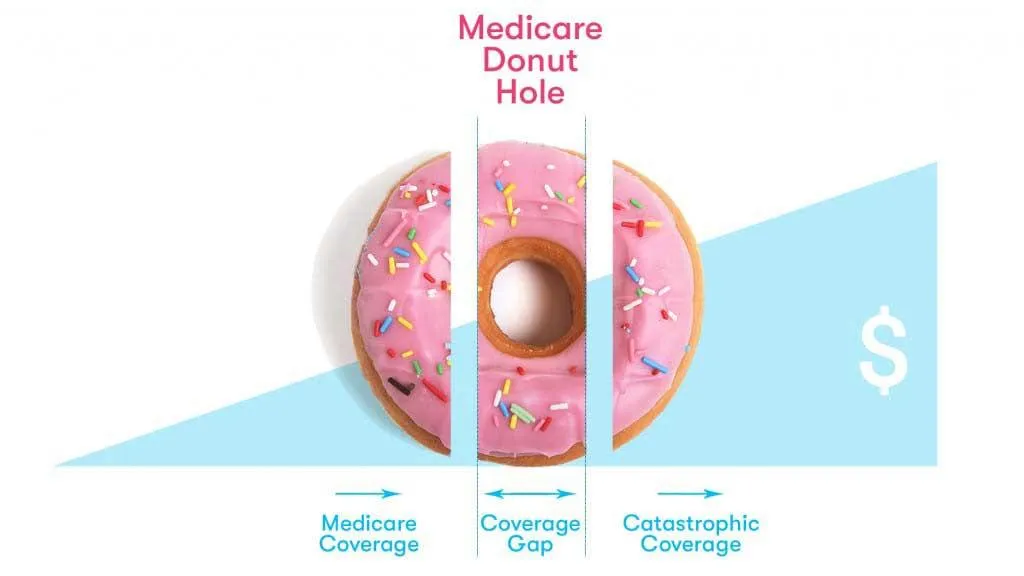

This situation creates a coverage gap for some beneficiaries, as they reach their annual coverage limits and then have to pay more out-of-pocket in the middle of the coverage year. This coverage gap is often called the “Part D Donut Hole”.

Medicare Part D Works in 4 Stages

To understand how the Donut Hole happens, you must learn how Part D coverage works each year. Coverage occurs across four stages, and you might fall into the Donut Hole depending upon how much of your coverage you use.

Stage One begins on January 1, the beginning of your coverage year. During this stage you are responsible for paying your prescription drug costs, up until you reach your plan deductible, which is $505 for 2023.

Stage Two begins when you’ve reached your deductible. At this point you are responsible only for co-pays each time you fill a prescription.

Stage Three begins when you and your plan (combined) have spent $4,660 (2023) on prescription drugs for the year (including the deductible). You’re now in the Donut Hole, and will pay a percentage toward each of your medications.

Stage Four of Part D coverage is known as Catastrophic Coverage. Once you spend up to a threshold of $7,400 for the year (2023), you move into this stage. Part D now covers 95 percent of the cost of your prescriptions, and you are responsible for just 5 percent.

Good News: The Donut Hole is Closing!

Before the Affordable Care Act passed in 2010, beneficiaries who fell into the coverage gap would be responsible for 100 percent of the cost of their prescription drug costs at that point in the coverage year. Since then, they have been reducing that percentage annually.

Now, Medicare beneficiaries are charged no more than 25 percent of the cost of brand name prescriptions when they fall into the gap. The percentage beneficiaries pay for generic drugs is capped at 37 percent, but of course we know that the overall cost of generics is often much lower anyway.

What Can Beneficiaries Do About the Donut Hole?

Even though the Donut Hole is shrinking, it is still a problem for some beneficiaries. Your Part D administrator will send you monthly statements to help you track your spending, so that you will know that you’re approaching the coverage gap.

Sometimes there is no way to avoid the Donut Hole completely, but beneficiaries can take steps to reduce their costs. Use generic medications whenever possible, and talk to your doctor about alternative medications that work just as well but are more cost-friendly.

To speak with a licensed agent, call (512) 567-2993 or (855) 496-3342

(TTY 711 M-SU, 8am-8pm)

TX: 2639620

Georgetown, TX

Have You Watched Our Medicare Essentials Video Quick-Course?

This video tutorial covers the basic elements of Medicare in a format that is easy to understand and you can watch it from the comfort of home! It’s yours at no cost and no obligation, just tell us where we should send it!

Get Free Medicare

Assistance

Friendly, licensed professionals are available to answer all

of your questions. Call (512) 567-2993 or (855) 496-3342 or

complete the form below and we’d be happy to reach out

to you.

To speak with a licensed agent, call (512) 567-2993 or (855) 496-3342

(TTY 711 M-Sun, 8am-8pm)

TX: 2639620

Georgetown, TX

© 2023 Envisioncare Insurance Group. All Rights Reserved. Website Design and Marketing by Medicare Marketing 24/7

Medicare has neither reviewed nor endorsed this information.

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact

Medicare.gov or 1-800-MEDICARE to get information on all your options.