Book Reading Recommendations by Curtis May

Who took my money? by Robert T. Kiyosaki

Thought-provoking book that delves into the complex world of investments and exposes common financial myths.

The author offers practical advice on protecting and growing wealth, while shedding light on the forces that can erode financial security.

Cash Flow Quadrants by Robert T. Kiyosaki

Explores four different ways people earn income: as employees, self-employed individuals, business owners, or investors. The book highlights the importance of shifting from the left side (employee/self-employed) to the right side (business owner/investor) for financial success.

Rich Dad Guide to Investing by Robert T. Kiyosaki

Provides valuable insights into the world of investing and aims to empower readers to make informed financial decisions. The book emphasizes the importance of financial education, strategies for wealth creation, and the mindset required to navigate the investment landscape.

Think and Grow Rich by Napoleon Hill

Timeless classic in the field of personal development and success. The book explores the power of mindset and teaches principles for achieving wealth and success by harnessing the potential of thoughts and beliefs.

Be Your Future Self Now By Dr. Benjamin Hardy

Transformative guide that challenges individuals to envision and embody their ideal future selves. Through practical strategies and exercises, the book empowers readers to make intentional choices and take actions that align with their desired future outcomes.

10x is Easier Than 2x By Dr. Benjamin Hardy

Motivational book that encourages readers to think bigger and aim for exponential growth in their personal and professional lives. The book provides strategies and mindset shifts to help individuals break through limitations and achieve extraordinary results.

Economics In One Lesson by Henry Hazlitt

Concise and influential book that introduces readers to key economic principles. Hazlitt debunks common fallacies and emphasizes the importance of considering the long-term consequences of economic policies and actions.

The Richest Man in Babylon by George S. Clason

Timeless financial classic that imparts essential principles of wealth accumulation and personal finance through engaging parables set in ancient Babylon. The book emphasizes the importance of saving, investing, and making wise financial decisions.

Become Your Own Banker by Nelson Nash

Introduces the concept of infinite banking, a strategy that empowers individuals to take control of their finances and build wealth through specially designed whole life insurance policies. The book explores the benefits and strategies of this unique approach.

Learning to Avoid Unattended Consequences by Leonard A. Renier

If something you thought to be true, wasn't true, when would you want to know about it? In your financial world, that defining moment occurs by understanding the Efficiency of Money.

12 Week Year by Brian P. Moran

Powerful framework for achieving greater results in less time. The book challenges the traditional annual goal-setting approach and offers a focused 12-week system to enhance productivity, execution, and overall performance.

Principles Based Planning by Kyle J Christensen

If the purpose of financial planning is to help people become financially independent, it has failed. It has failed because it's built on the sandy foundation of Financial Needs Analysis (FNA). After decades of the financial services world promoting FNA we are not seeing record levels of success. We are seeing record levels of dependence on Social Security and other welfare programs. We are seeing consistently decreasing levels of life and disability insurance protection. We are seeing people retire that have nowhere near sufficient funds to replace their income.

The Five Major Pieces to the Life Puzzle

If the purpose of financial planning is to help people become financially independent, it has failed. It has failed because it's built on the sandy foundation of Financial Needs Analysis (FNA). After decades of the financial services world promoting FNA we are not seeing record levels of success. We are seeing record levels of dependence on Social Security and other welfare programs. We are seeing consistently decreasing levels of life and disability insurance protection. We are seeing people retire that have nowhere near sufficient funds to replace their income.

What would the Rockefellers do by Garrett Gunderson

Imagine one of your great- grandchildren presiding over a family fortune. And imagine that, whenever your great-grandchild puts that money to good use, they toast you—because you started it all. You amassed wealth and left behind a set of values and a financial legacy to shepherd that wealth.

Is this possible? Is it possible for you to live wealthy, not only leave your kids better off than you were, but also spark a financial legacy of wealth and empowerment that lasts for generations?

The Lifestyle Investor: The 10 Commandments of Cash Flow Investing for Passive Income and Financial Freedom

The Lifestyle Investor is your ticket to:

End trading time for money so you have more of both

Create immediate cash flow while reducing your investment risk

Replace your job with passive cash flow streams that multiply your wealth so you can live life on your terms.

Join the super-achievers experiencing wealth and freedom today!

Entrepreneur Magazine calls Justin Donald the "Warren Buffett of Lifestyle Investing." He's a master of low-risk cash flow investing, specializing in simplifying complex financial strategies, structuring deals, and disciplined investment systems that consistently produce profitable results. His ethos is to "create wealth without creating a job.

Pirates of Manhattan

The Pirates of Systematically Plundering the American Consumer & How to Protect Against It Dyke examines systematic fraud, deceit and corruption that is commonplace in Wall Street and big banks. It documents how often times the very financial institutions that want you to speculate with YOUR money, in fact do not speculate with THEIR money. The book covers a a many topics The Federal Reserve and it's impact on the average American. The repeal of The Glass-Stegall Act and the passage of The Gramm-Leach-Biley Act of 1999. Why big banks want all regulations to be consolidated at the federal level. Wall Street and it's appetite for speculation (The Casino Age) How big banks circumvent state usury laws that allow them to charge twenty plus percent on credit cards loans.

Ready to take the next step?

Schedule a FREE consultation with one of the experts on our team.

It all starts with a quick Zoom call. You can tell us about your personal finances and the challenges and opportunities you face, and see if we’re a good match.

Let's chat about what you want your money to do

You’ll learn about whole life insurance & how it can help you.

We’ll answer any questions you’ve got.

Choose your payment option:

$49/month

$499/year

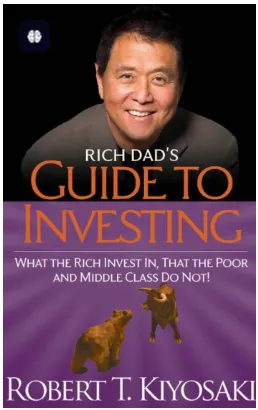

Post Address and Mail

Email: [email protected]

Address

Office:

14 E Stratford Ave Suite 2b Lansdowne Pa 19050

Get In Touch

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

610-622-3121

Disclosure: Our content is meant for educational purposes only. While it’s our goal to help you learn about building a life of prosperity, we do not intend to provide financial advice. Please consult your financial, tax or legal advisor before making any investment or financial decisions. Information is only available to people who have a presence in the US.